Obtaining the appropriate startup investment is frequently the key to success in the ever-changing world of startup entrepreneurship. Angel investors are essential to this process because of their propensity for supporting new businesses.

We will examine the important aspects: What role do Angel Investor Strategies play?, How to write captivating startup investment pitches?, Investor Confidence Factors, Startup Funding Strategies, and finally Achieving Entrepreneurial Investment Success.

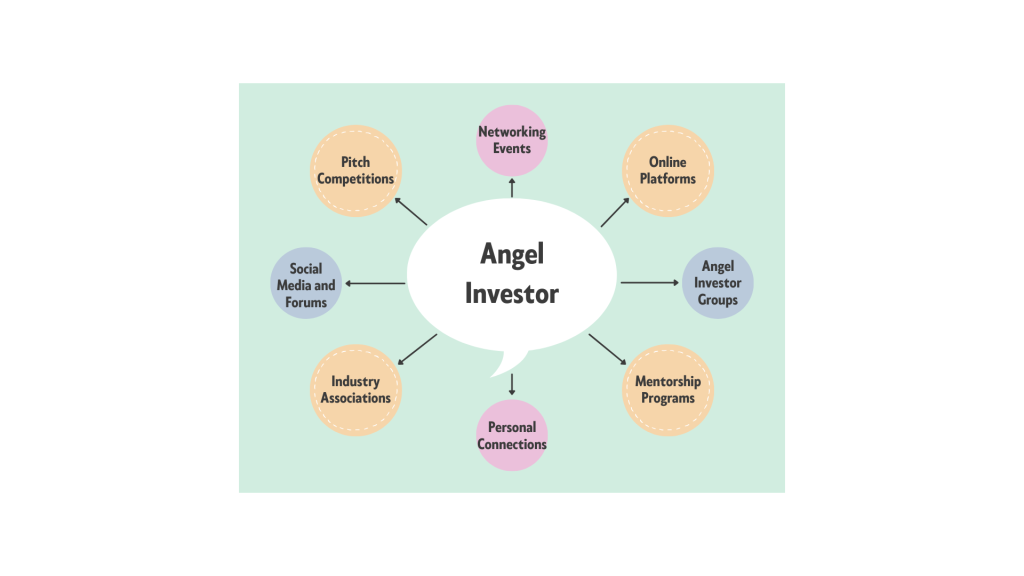

Source: How to find angel investors for your startup investment?

What role do Angel Investor Strategies play?

Angel investors are strategic partners in search of ventures with significant development potential, not merely donors of capital. Entrepreneurs must develop a thorough plan that satisfies these investors’ requirements and preferences. The first stage to success is determining the appropriate investors and adjusting the strategy accordingly.

Angel Investor Strategies entail conducting in-depth market research to identify possible backers who have previously made investments in projects of a similar nature. It’s important for entrepreneurs to know which particular businesses, sectors, or technology these investors are interested in so entrepreneurs can adjust their pitches appropriately. A focused and well-thought-out approach not only shows dedication but also raises the possibility of attracting possible angel investors.

Angel investors are 60% more interested in startups with distinct value propositions.

How to write captivating startup investment pitches?

An engaging startup pitch is more than simply a presentation; it’s a narrative that draws in investors and helps them see the venture’s possible success. A strong go-to-market strategy, a scalable business model, an inventive solution, and a well-defined issue statement are all essential components of an effective pitch.

Entrepreneurs need to highlight the special value that their business offers. What distinguishes this enterprise from others? In what way does it solve a market pain point? In the pitch, these queries ought to be succinctly and convincingly answered.

Furthermore, adding data-driven insights and showcasing traction may greatly increase the credibility of the proposal. Whether it’s revenue growth, user acquisition stats, or successful pilot programs, demonstrating measurable achievements to angel investors boosts their confidence and emphasizes the startup’s feasibility.

Successful pitches increase funding chances by 75% among angel investors.

How can investor confidence factors be decoded?

Any successful fundraising campaign is built on the foundation of investor confidence. Although angel investors are risk-takers by nature, they also want to know that their money is being invested wisely. Entrepreneurs need to concentrate on elements that foster investor trust in order to provide the groundwork for a win-win collaboration.

Honesty and transparency are essential components in winning over investors. A realistic awareness of the venture’s terrain is demonstrated by clearly describing the risks and obstacles in addition to the benefits.

Additionally, business owners should present a skilled and flexible group that can handle ambiguity and seize chances. This entails giving investors access to pertinent paperwork, financial records, and any other data that would be necessary for them to make wise selections. Potential angel investors are more confident in a business that is prepared and open.

How can you investigate various small business startup financing strategies?

Angel investors are a major source of funding, but in order to minimize risks and optimize possibilities, companies should diversify their funding sources. Comprehending the several funding alternatives accessible and customizing the approach to the unique requirements of the nascent enterprise is vital.

In addition to angel financing, companies may consider government grants, venture capital, crowdsourcing, and strategic alliances. Every financing source comes with a unique combination of benefits and difficulties. Developing a diverse finance strategy not only protects the firm from unanticipated obstacles but also demonstrates the entrepreneur’s flexibility and strategic thinking.

The trade-offs of each financing source should be carefully considered by entrepreneurs, who should then design a balanced funding mix that fits the startup’s development trajectory. In addition to providing the required funds, a well-rounded financing strategy presents the firm as a reliable and alluring investment option.

What is an entrepreneurial investment for startup funding?

Success with entrepreneurial investments is the result of a carefully considered plan, strong pitches, investor trust, and a varied financing source. It’s not only about getting money; it’s also about laying the groundwork for long-term collaborations and sustainable growth.

It is essential to continuously improve tactics in response to input from possible investors. Every conversation an entrepreneur has with an investor is a chance to grow and adjust. Including criticism not only makes the pitch better, but it also shows that you are dedicated to making improvements, which is something angel investors want.

Creating a strong network inside the startup ecosystem is another way to succeed with investments. Interacting with mentors, business owners, and industry experts offers insightful information and may even lead to new prospects. Entrepreneurs may present their projects and make connections with possible angel investors on stages such as conferences, networking events, and pitch competitions.

Take Away: Start up business grants

Getting angel investors to companies is a complex process that calls for a strategic approach, strong communication abilities, and a dedication to fostering investor trust.

Entrepreneurs can successfully navigate the difficult terrain of fundraising by putting angel investor strategies into practice, creating compelling startup pitches, giving investor confidence factors top priority, investigating various startup funding approaches, and persistently striving for entrepreneurial investment success.

To get assistance to know more about it, contact Team BAI (#BringAnImpact)